Because managerial accounting deals with the parts rather than the whole it is much more adept at identifying financial problems and how to fix them. The main objective of managerial accounting is to produce useful.

On the other hand management accounting is a new field of accounting that studies managerial aspects.

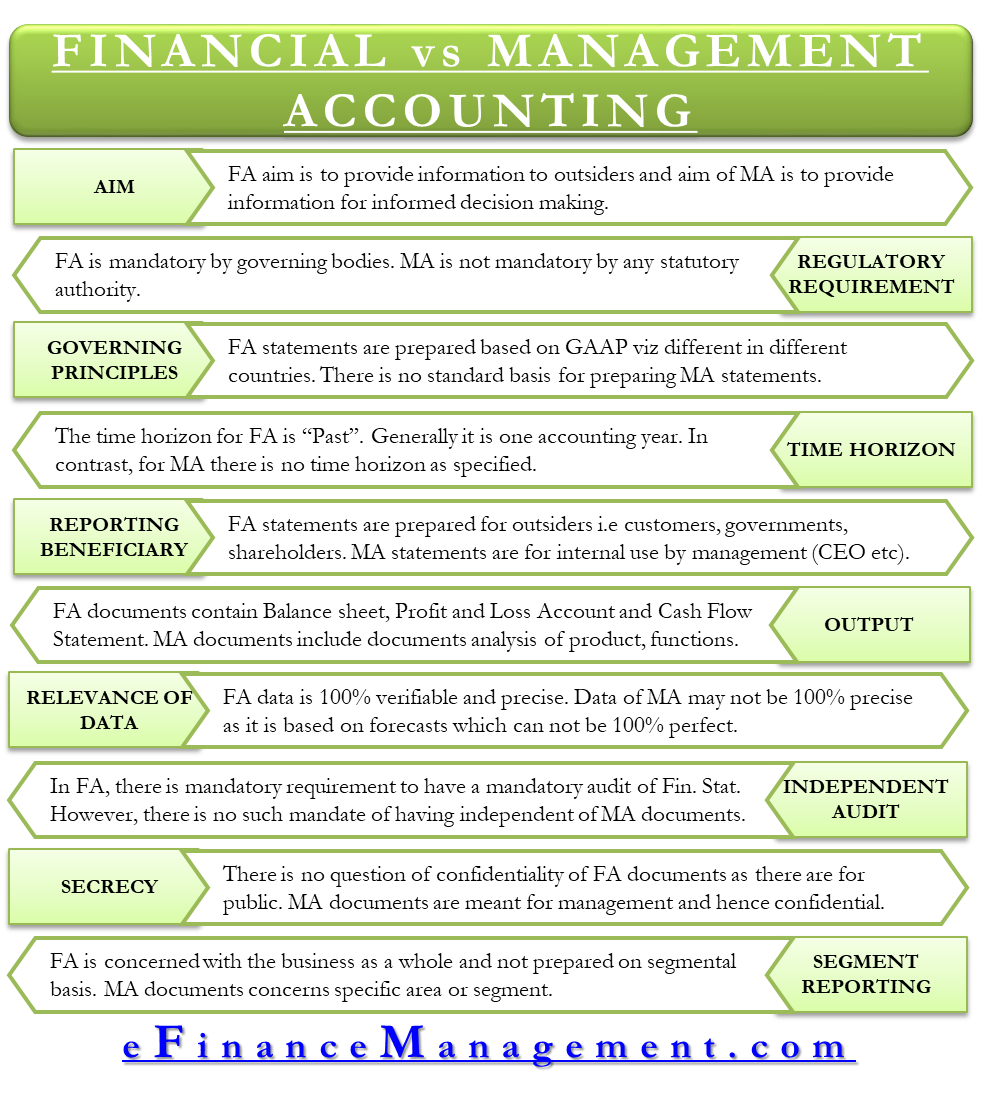

. It deals with the provision of financial. The key difference between financial accounting and managerial accounting lies in the intended users of information for each. Can you explain in detail the differences between financial and managerial accounting.

Managerial accounting focuses on an organizations internal financial processes while financial accounting focuses on an organizations external financial processes. The information created through financial accounting is entirely historical. Who are the experts.

Experts are tested by Chegg as specialists in their subject area. Managerial accounting focuses on problems and solutions within an organization while financial accounting. Past and Present Use.

Financial accounting reports on the profitability and therefore the efficiency of a business whereas. Financial accounting takes a wider view and examines the financial status of the entire business. While managerial accounting puts out profit and loss statements job costing reports and operating budgets financial accounting delivers numbers only for those on the outside who need to determine the companys market evaluation.

Differences between Managerial and Financial Accounting 1. Both forms of accounting process the same underlying data to report financial information to its users. Managerial accounting focuses on detailed reports like profits by product product line customer and geographic region.

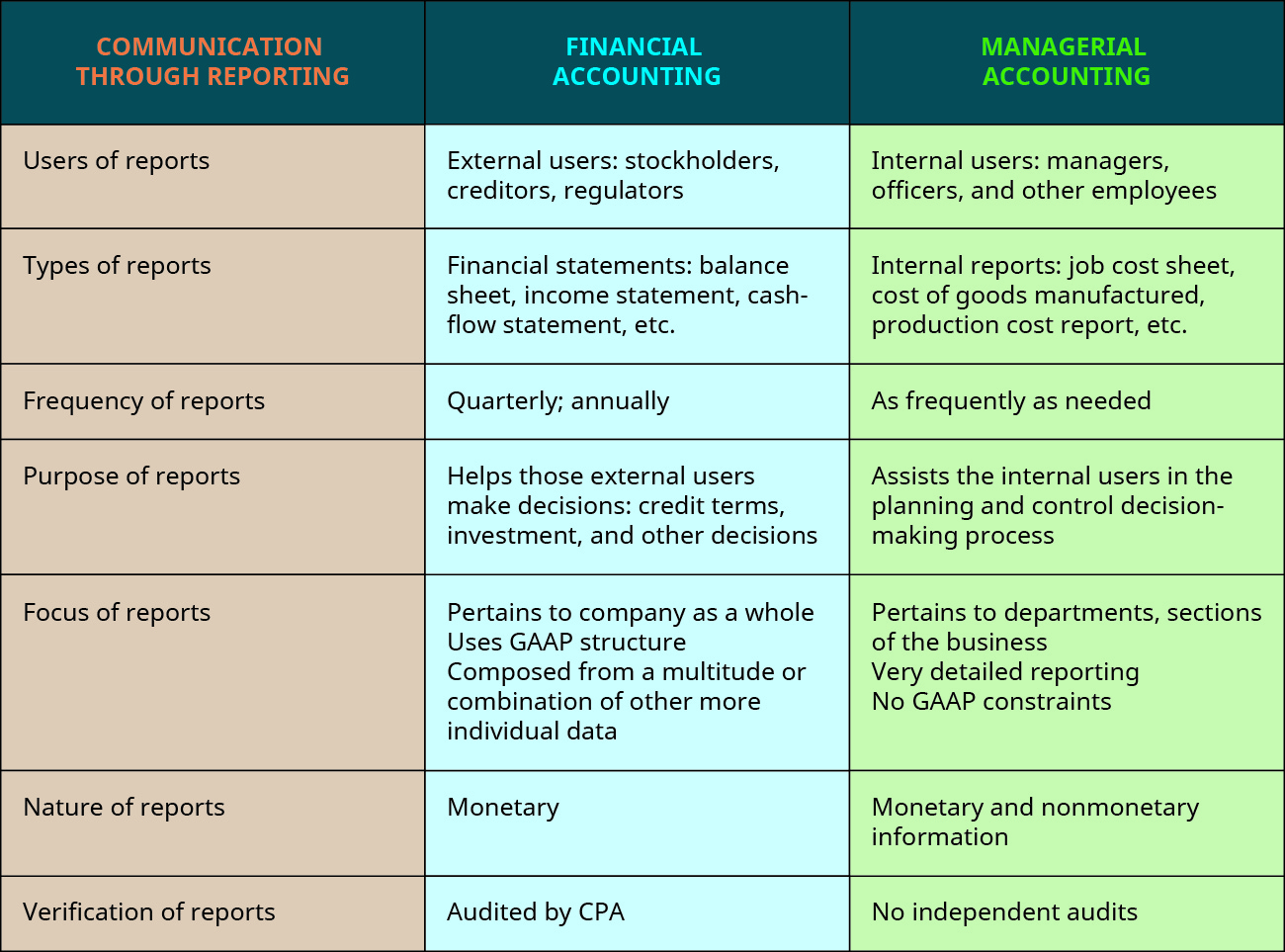

However they are prepared primarily for external users such as the investors lenders and creditors and the government. Users types of reports produced frequency of producing the reports purpose of the information produced focus of the reporting information nature of the original information used to produce the reports and verification of the data used to create the reports. How Financial Accounting Differs From Managerial Accounting Main Objectives of Both Accounting Practices.

The reports prepared in. The Financial Accounting reports are not useful for planning organizing staffing directing controlling and decision-making. Financial accounting provides financial data to third parties outside of the company while managerial accounting provides important information that allows managers within the organization to make informed business decisions.

2 Problem Solving vs. The Management Accounting information are mainly used by the top level management executives of a business concern. In contrast financial management refers to managing finances and investment opportunities of different.

Even though financial accounting is of great importance to current and potential investors management accounting is necessary for managers to make current and future financial decisions for their. Compare actual costs and financial results with budgeted costs and results. Financial accounting heavily used by public regulators creditors and shareholders.

A creditor and a manager would need different. Managerial accounting focuses on operational reporting to be shared within a company. Financial accounting and management accounting are parts of the same accounting system.

What types of documents are prepared by business organization using financial and managerial accounting. The difference between financial and managerial accounting Aggregation. The first difference is that management accounting is presented to a companys internal community while financial accounting is prepared for an external audience.

Another big difference between financial and management accounting involves the persons who will be using the information that the accountants provide. Main Differences Between Financial Accounting and Management Accounting. Financial Accounting provides financial information about a company to the third part organizations doing business with the company as well as general public.

Managerial accounting on the other hand provides specific financial information that helps managers and other top company executives make various decisions pertaining to the company. General purpose financial statements can be used by external and internal users. The financial accounting information are mainly used by the external to the business enterprise.

Managerial accounting almost always. Managerial accounting is used for internal purposes while financial accounting provides financial information based on accounting. The difference between financial accounting and management accounting is very important to understand as both of them serve different purposes and audiences.

Managerial accountants focus on short-term growth strategies relating to economic maintenance. Financial accounting reports on the results of an entire business. Financial accounting looks at the entire business while managerial accounting reports at a more detailed level.

The key difference between financial accounting and management accounting is that financial accounting is the preparation of financial reports for the analysis by the external users interested in knowing the companys financial position. Determining the cost of providing a service or making a product. Assist management in profit planning and formalizing the plans into budgets.

We review their content and use your feedback to keep the quality high. Financial Accounting is the original form of accounting that deals with recording business transactions and summarizing the data into reports which are presented to the users so that financial decisions can be made rationally. A person from the management may not find certain information relevant and at the same time a cost accountant cant work without this information.

For the most part financial accounting is responsible for disseminating the overall health of the business to external users whereas management accounting produces financial. The Management of the company is the only body that can have access to the reports of the Management Accounting. 15 rows 3.

In contrast management accounting is the preparation of financial and non-financial information which helps managers make policies. The fundamental difference between Financial Accounting and Financial Management is that financial accounting is the process of recording maintaining and reporting the companys financial affairs that depict the companys clear financial position. There are seven key differences between managerial accounting and financial accounting.

Determine the behavior of costs and how profit will change as sales and.

Difference Between Financial And Management Accounting Efm

Difference Between Financial Accounting And Management Accounting Finlawportal

Management Accounting And Financial Accounting Project Management Small Business Guide

Distinguish Between Financial And Managerial Accounting Principles Of Accounting Volume 2 Managerial Accounting

0 Comments